Mortgage Payment Structure: A Short Guide

Mortgage loans are typically long-term so that you can buy a home and pay for it in convenient monthly installments. But when you make repayments, you are required to pay the principal amount along with interest to the lender. Taxes and insurance premiums may be additional components of your monthly payout.

Principal Payment

The principal refers to the actual loan amount which you borrow at the time you take out a mortgage. To get an idea of what is your principal amount, look at the final buying price of your home and deduct the down payment from it.

For instance, if your final purchase price is $300,000 with a down payment of 15%, it means you are paying $45,000 upfront. Your lender will finance the remaining amount of $255,000.

At the time of your loan origination, you will owe this amount to your lender, which becomes your principal balance. This is the most significant figure for you to determine your affordability because you will be repaying it back in installments along with interest.

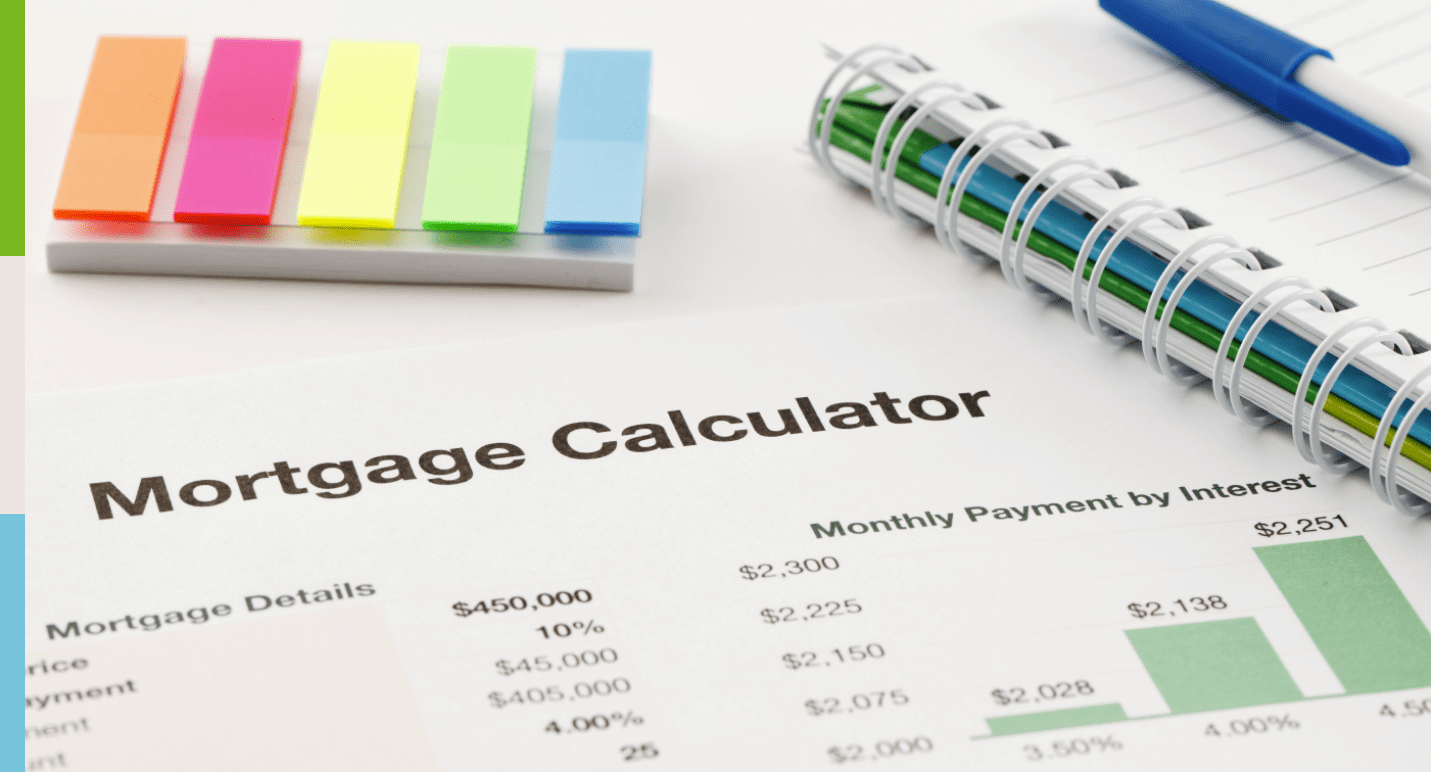

Interest will start accruing as soon as you take out the mortgage. Taxes, insurance, repairs, and maintenance, are some other expenses that you may have to account for. You may use a reliable online mortgage calculator to determine a broad estimate of your all-inclusive monthly repayment amount or seek advice from your loan officer.

Interest Payment

After the principal balance, the interest is another component of your monthly loan repayment. Interest is the lending cost of your loan, which you pay to your lender in return for obtaining a mortgage. Interest is usually computed as APR (annual percentage rate). The interest amount that you pay each year on your loan is your APR.

For instance, if you borrow $250,000 at 4% APR, your annual interest payment will be $10,000. In the initial stages, when the principal balance is high, a large part of your monthly payment is likely to go towards interest payment only. However, as time progresses, your principal balance will continue to decrease.

Your interest rate will not only depend on the prevailing market rates, but may also be impacted by your credit score, the amount of down payment you make, and other factors. By improving your credit score, you can aim to bring down your interest rate at the time of taking out the mortgage loan.

Remember that even a very marginal difference in your APR for a fixed-rate mortgage loan can translate into thousands of dollars over the life of your loan. Therefore, evaluate your principal, down payment, and interest rate carefully before you buy a new home or refinance an existing mortgage.

Taxes

You are likely to incur property taxes on your home. It is easy to ignore this part of your mortgage payment structure, but it can turn out to be a significant amount. Your taxes will be determined according to the market value of your home, the amenities provided in your community, and the area where your property is located.

One of the reasons why it makes sense to obtain an appraisal on a new home is that it will ensure the property taxes are appropriately applied by the local authorities. Tax rates can change at any time, and you may have to get a new appraisal if and when your county requires it.

Insurance

Although it is not mandatory to buy a homeowners’ insurance policy when you are purchasing a new home, mortgage lenders will make it a requirement for your loan approval. Homeowners’ insurance covers your financial risk against damage to your property from storms, fire, and burglary. For protection against risks such as earthquakes and floods, you can buy additional coverage.

If you are planning to keep highly valuable items in your home that require financial protection, you can add a rider to your policy. This will extend your coverage amount for the particular item as you require. The premium cost for your homeowners’ insurance will vary depending on the value of your home, its age and location, how distant is your home from a police station or a fire department, and additional risk factors (such as a pool at home).

Escrow

Depending on your situation, your lender may decide to keep a percentage of your monthly mortgage payment towards an escrow account. This account will hold the amount that you owe in insurance premiums and property taxes. Some mortgage lenders may collect this amount and make the payment on your behalf.

This is done to ensure that you will comply with your tax and premium payments. The amount that you pay in escrow account will be determined according to your actual insurance and tax charges. Whenever there is a change in these rates, the mortgage lender could revise your escrow holdings.

Prime Choice Funding is here for you. If you are planning to purchase a new home or refinance your existing home, we can help with your homeownership goals, call us at (877) 787-7463 or contact us here.