Between the Federal response to COVID-19 and individual states enacting their own measures, there is a growing need for accurate information – especially financial aid. Mortgage forbearance is a tool gaining more attention as the situation evolves. So, what is a forbearance and how does it help you?

How Forbearance Works

At a basic level, it is an agreement between you and your lender to temporarily suspend payments for certain time. Your payments can be deferred or lowered during this time-frame, and your lender agrees not to foreclose due to missed or late payments. These missed payments do not extend your loan term. This makes forbearance ideal for temporary financial setbacks, like job loss.

That said, forbearance is not forgiveness. You still owe the payments you missed.

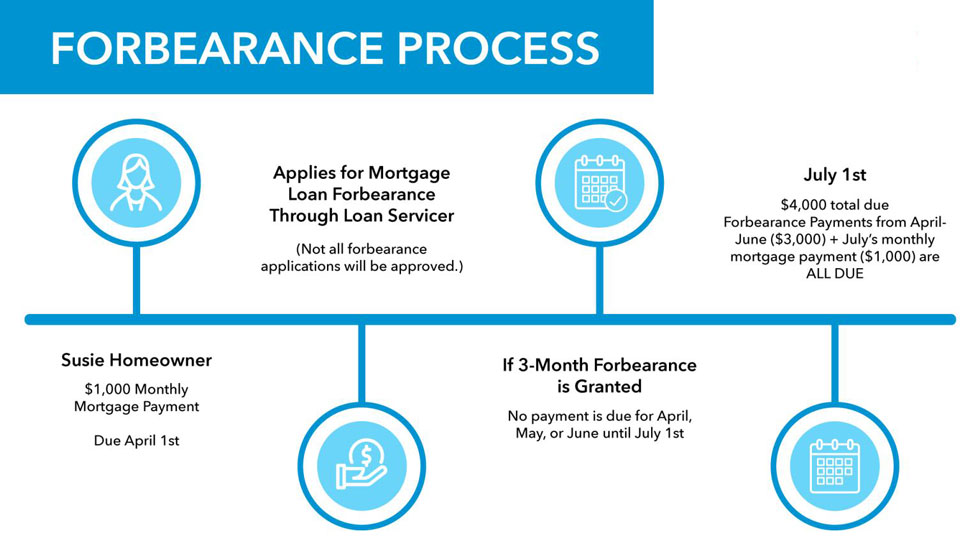

Here is a visual breakdown of the process:

The specifics of your agreement will vary lender to lender. Some require you to pay in full once the forbearance is over, while others are willing to provide flexible repayment options. You may also need to make modified payments during that time (i.e. interest-only or lowered amounts).

Does This Impact my Credit?

Forbearance has little impact on your credit. Lenders are not obligated to report the agreement, and they typically do not report payments as late or missing. By contrast, foreclosures and missing payments have a greater impact.

If you do enter a forbearance agreement, monitor your credit to make sure you are not taking a hit. The FACT Act of 2003 entitles you to a free credit report every 12 months from the major credit bureaus: Equifax, Experian, and TransUnion.

Can Forbearance Affect Future Mortgage Applications?

This depends on the lender and the situation. Lenders may be wary when reviewing your financial history for risk, since forbearance indicates an inability to make mortgage payments – even if temporary. However, it is unclear that entering forbearance due to the current crisis would negatively impact you for future applications.

Is This Right for Me?

As we mentioned above, people with temporary financial hardship would benefit the most. Your first step should be to speak with your lender about their options for financial hardship. They may offer more alternatives to explore. Remember, forbearance is not uniform across the mortgage industry. Each lender will have different terms and expectations.

Long-term changes to your financial situation may require more extensive solutions such as loan modifications or lender specific programs. You can also speak to a government certified housing counselor to explore your options.